Viking Dragon at Shanghai Port – Photo: Wikicommons

The Chinese cruise market is one of the most volatile in the world. Insiders in the Chinese cruise sector are keeping a close eye on the industry’s ebb and flow, from its rapid ascent to its precipitous fall during the pandemic and its promising return.

From 2010 to 2020, China was on the edge of becoming an unrivalled force in the cruise industry, with an explosive increase in Chinese guests aboard cruise ships and a burgeoning ship construction industry. However, the pandemic dramatically altered the course. Now, with concerted efforts, China is determined to reclaim its status as the world’s most significant emerging market in cruising.

Before the pandemic, China’s cruise industry was on an impressive growth spurt. Chinese consumers quickly became dominant in the cruise market, second only to Americans. From 2009 to 2019, the global cruise industry expanded annually by 5.28%, with passenger numbers soaring from 17.8 million to 29.7 million. However, in China, these numbers reached 70% in some years. Chinese passengers represented 8% of the global number of cruise passengers in 2019.

One area that symbolizes the best growth is, remarkably, Antarctica. The expedition cruise market was one of the first sectors in the cruise industry to recognize the possibilities that Chinese guests offered. In a decade, the number of Chinese tourists travelling to Antarctica dramatically increased. The numbers surged from fewer than 100 tourists in 2008 to more than 8,000 ten years later.

The Pandemic’s Impact

Before the pandemic, almost every leading cruise company had vessels operating in China, intending to deploy additional ships, establish cruise ships, and even cruise lines tailored for the Chinese market. However, the hardest hit of all during the pandemic was China’s burgeoning market. The sudden pause in operations resulted in a nearly three-year-long complete shutdown in China, almost devastating the Chinese market.

Yet, the sector’s resilience began to show as early as 2023, when China started to relax COVID-19 restrictions and opened its borders once more.

Signs of the New Golden Age of Cruising

By the latter half of 2023 and into the early months of 2024, signs of a significant revival began to emerge within the Chinese cruise market. This was supported by the reopening of borders and the resumption of tourism. It is no surprise that companies such as MSC Cruises are eager to return.

“The restart of international cruise operations from China sends a strong signal to the world, and we are glad to experience the incredible recovery speed here in the Chinese cruise market. China continues to play an important strategic role for MSC Cruises,” said Gianni Onorato, CEO of MSC Cruises.

As China continues its recovery, the world watches with bated breath, eager to see the resurgence of this significant player in the global cruise industry. China’s cruise market’s journey serves as a testament to the industry’s resilience and potential, even in the face of unprecedented challenges.

The Chinese cruise market, characterized by dramatic fluctuations and a promising comeback, is set to reclaim its status as the world’s most significant emerging market in cruising. Major players in the industry, including Royal Caribbean International and Viking Cruises, are making significant strides in this market, contributing to its growth and development.

Royal Caribbean International plans to sail on 120 cruises through 2026 from Shanghai onboard Spectrum of the Seas. Viking Cruises has established its cruise division in China, which includes ocean-going and river ships. Additionally, Carnival-backed Adora Cruises plays a crucial role in the growth of China’s cruise industry.

Qiu Ling, chairman of the Shanghai International Cruise Business Institute, highlighted the impact of these developments: “In the past few years, the participation of Chinese cruise companies, including Adora Cruises and China Merchants Viking Cruises, has not only brought more capacity to the Chinese cruise market but also prompted the overall cruise industry chain to improve and develop.”

Government-Backed Growth and Infrastructure Investments

China’s government is backing this growth with significant investments in infrastructure. The Wusongkou International Cruise Port in Shanghai, the largest in Asia and one of the biggest worldwide, was built in anticipation of the expected boom in the cruise industry.

The first Chinese-built and operated cruise ship, Adora Magic City, has seen a spectacular launch period, with sailings around the lunar new year sold out well in advance.

China’s cruise sector is poised to enter a golden age, projected to create an economic impact worth $81.05 billion by 2035. This growth is driven by an anticipated surge in Chinese cruise passengers and a rapidly developing shipbuilding industry.

To further boost growth, the Ministry of Transport and other government organizations released a combined strategy to transform China’s cruise industry into a global powerhouse. They forecast 14 million cruise passengers to set sail annually by 2035. To put that in perspective, in 2024, the total number of cruise passengers is expected to reach 36 million worldwide.

The strategic importance of China’s cruise industry in the global cruise sector is evident in the efforts by the biggest names in the industry, backed by the Chinese government, to rebuild China’s cruise industry. With infrastructure investments and strategies aimed at increasing passenger numbers, China’s role in cruising could be much bigger than many expect. This resilience and revival of China’s cruise market serve as a testament to the industry’s potential, even in the face of unprecedented challenges.

How Royal Caribbean Group Just Changed Cruise Loyalty Forever

How Royal Caribbean Group Just Changed Cruise Loyalty Forever  Celebrity Xcel Unveils Mediterranean Festivals at The Bazaar for Europe 2026 Sailings

Celebrity Xcel Unveils Mediterranean Festivals at The Bazaar for Europe 2026 Sailings  Norwegian Aura: Norwegian Cruise Line’s Biggest Ship Brings Ocean Heights Fun and Caribbean Cruises from Miami in 2027

Norwegian Aura: Norwegian Cruise Line’s Biggest Ship Brings Ocean Heights Fun and Caribbean Cruises from Miami in 2027  Inside the InTUItion Class: How TUI Cruises Redefines Luxury and Well-being at Sea

Inside the InTUItion Class: How TUI Cruises Redefines Luxury and Well-being at Sea  Norwegian Cruise Line Unveils Great Life Lagoon: All-New Pool, Cabanas and Waterpark Upgrades at Great Stirrup Cay

Norwegian Cruise Line Unveils Great Life Lagoon: All-New Pool, Cabanas and Waterpark Upgrades at Great Stirrup Cay  Princess Cruises Expands 2027 Northern Europe Season With 48 Sailings and New Grand Voyages

Princess Cruises Expands 2027 Northern Europe Season With 48 Sailings and New Grand Voyages  Knai Bang Chatt Launches ‘The Regenerative Stay’ to Turn 2026 Kep Holidays into Mangrove Restoration

Knai Bang Chatt Launches ‘The Regenerative Stay’ to Turn 2026 Kep Holidays into Mangrove Restoration  Trafalgar Harmonie to Sail the Seine in 2027 as Trafalgar Expands European River Cruise Fleet

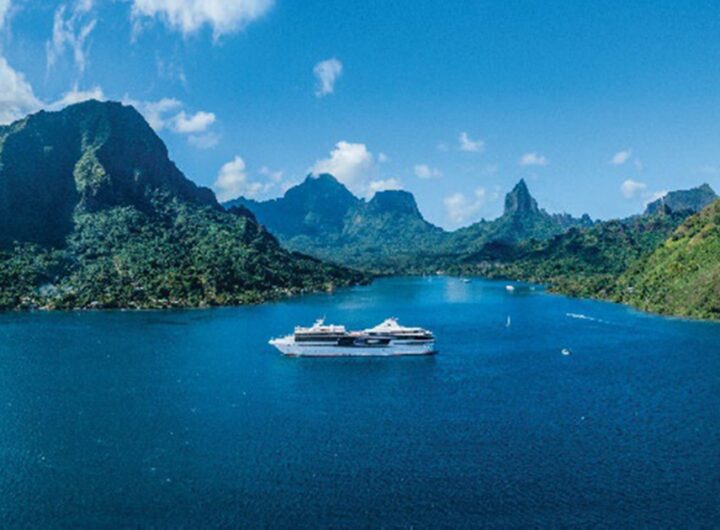

Trafalgar Harmonie to Sail the Seine in 2027 as Trafalgar Expands European River Cruise Fleet  Ponant Explorations Group Expands in French Polynesia with Dual-Ship Deployment and New ‘Polynesian Bliss’ Voyages

Ponant Explorations Group Expands in French Polynesia with Dual-Ship Deployment and New ‘Polynesian Bliss’ Voyages  Amangati Float-Out: Aman’s Ultra-Luxury “Resort at Sea” Prepares for 2027 Mediterranean Debut

Amangati Float-Out: Aman’s Ultra-Luxury “Resort at Sea” Prepares for 2027 Mediterranean Debut